Community Investment Tax Credit (CITC) Double Your Impact

Invest in Groundwork Lawrence and Receive a 50% of your Donation Rebate!

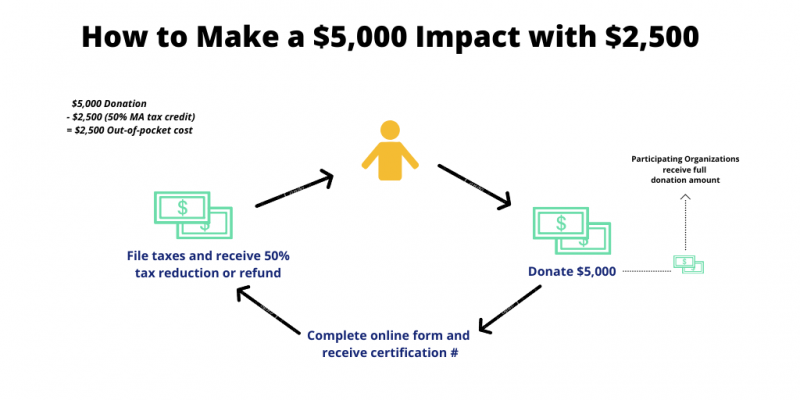

We are pleased to announce that you now have the opportunity to invest in Groundwork Lawrence in a new and exciting way through the Community Investment Tax Credit Program (CITC). Established by the Massachusetts Legislature with the goal of spurring more private donations to organizations doing community development work, the credit enables you to invest in GWL while receiving a substantial tax benefit. CITC provides a 50% tax rebate for your Massachusetts taxes.

How does the Community Investment Tax Credit Program work?

Tax Savings Examples

| Donation | $1,000 | $2,500 | $5,000 |

| CITC (MA state tax savings/rebate) | $(500) | $(1,250) | $(2,500) |

| Final Out of the Pocket Cost* | $500 | $1,250 | $2,500 |

*Please consult a professional tax adviser to determine final out-of-pocket cost for specific donations.