Invest in Groundwork Lawrence and Receive a 50% of your Donation Rebate!

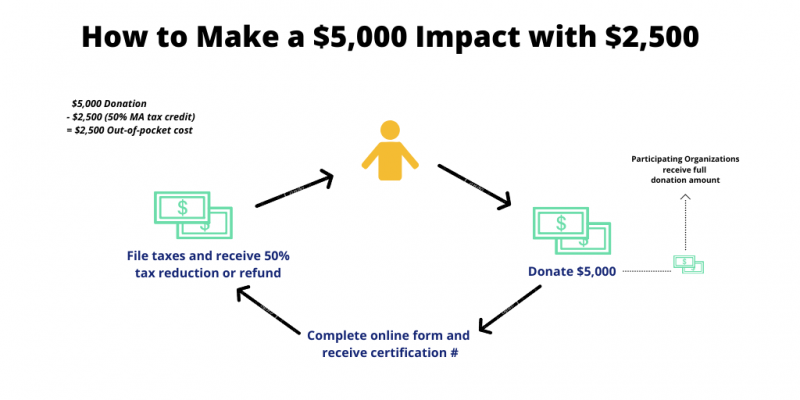

We are pleased to announce that you now have the opportunity to invest in Groundwork Lawrence in a new and exciting way through the Community Investment Tax Credit Program (CITC). Established by the Massachusetts Legislature with the goal of spurring more private donations to organizations doing community development work, the credit enables you to invest in GWL while receiving a substantial tax benefit. CITC provides a 50% tax rebate for your Massachusetts taxes.

How does the Community Investment Tax Credit Program work?

- Simply make an increased donation, $1,000 or more, to GWL and we'll send you the link to process your 50% tax credit (rebate)

- If you do not have sufficient tax liability, you will receive a check from the state for the amount of your credit (rebate)

- Minimum investment is $1,000

- Out of state filers are eligible, even if you don't owe Mass state taxes. Out of state filers must complete this form.

- Everyone qualifies, including: individuals, donor advised funds, foundations, and corporations

- Questions? Please contact our Development Director, Sharon.

|

TAX SAVINGS EXAMPLES |

|

|

|

|

Donation |

$1,000 |

$2,500 |

$5,000 |

|

CITC (MA state tax savings/rebate) |

$(500) |

$(1,250) |

$(2,500) |

|

Final Out of the Pocket Cost* |

$500 |

$1,250 |

$2,500 |

|

* Please consult a professional tax adviser to determine final out-of-pocket cost for specific donations |

|||

To participate in this program, donate here. Thank you in advance!